Image: Getty Images

The Australian Competition and Consumer Commission (ACCC) has reiterated its call for Google to implement a mandatory ‘choice screen’ for search engines after finding that the company’s dominance over the online research market had hurt competition and consumers.

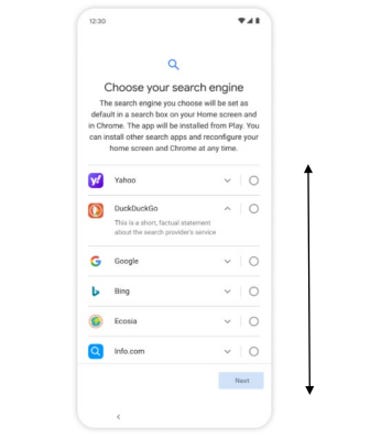

A choice screen is a setup page that presents consumers with a selection of search engines to use, rather than sending consumers to a predefined default search engine.

“Choice screens can give consumers the ability to make an informed choice about the search engine they use. Choice screens can also help reduce barriers to the expansion of Google’s competitors, which can provide consumers with more options for alternative search engines on issues such as privacy and how personal data is collected and used, â€said ACCC President Rod Sims.

The call was made as part of the Competition Watchdog’s Third Interim Report [PDF] for its five-year survey of digital platforms, which specifically examined the market dominance of Google search.

In the interim report, the ACCC said that Google currently has 94% of the online search market, which is largely due to the fact that Google Search is the default search engine predefined for Google Chrome and Apple Safari. . Chrome and Safari have a combined browser market share of over 80% on desktop devices and almost 90% on mobile devices.

According to the ACCC, Google gains significant value by being Safari’s default search engine, with Google estimated to receive around $ 8-12 billion in ad revenue per year as Safari’s default search engine, and the default Siri and Spotlight provider for search queries on Apple Devices.

The watchdog also noted, however, that Google’s royalty payments to Mozilla for having Google Search as the default search engine contributed more than 90% of Mozilla Firefox’s annual global revenue.

With this market dominance and control of key research access points, the ACCC said there would likely be less innovative services being developed and such services having limited scope. Examples of this are search engines that emphasize privacy and minimal data collection, such as DuckDuckGo and Brave.

The concept of screen choice isn’t new, as Google implemented the measure two years ago to get new Android devices in some European countries to comply with EU rules.

But the ACCC said the EU’s screen choice measure has had a “limited impact”, both in terms of level of market concentration and consumer reach, due to the design of the screen. EU Android screen of choice and its implementation as the screen of choice that only applies to new devices.

Example of a choice screen on an Android device.

Image: ACCC

Detailing how the ACCC wants the Australian version of the screen of choice to work, the regulator said the measure should initially apply to new and existing Android mobile devices and all search access points on those devices. Android mobiles.

He added that the screen-of-choice measure could also include a ban for a provider, who meets predefined criteria, from linking or bundling search services with other goods or services.

Other things pointed out in the interim report were that less than a third of respondents to the ACCC consumer survey in 2021 were aware of privacy-focused search engines and mobile browsers, despite the fact that 70 % of consumers reported concerns about the collection of personal data and information by browsers. and search engines.

The survey also found that 35% of consumers either did not know how to change the default browser on their mobile device or did not know if they knew how to do it. For computer use, this problem affected one in five consumers.

Last month, the ACCC criticized Google’s ad technology practices, accusing the tech giant of creating “systemic competition concerns” as part of its investigation into the Australian ad technology market.

By analyzing open display ads – which are online ads with the exception of those displayed on a general search engine or classifieds websites traded on open channels – the regulator found that the share of impressions of Google for the top four ad technology services used in Australia was between 70% and 100%, and for those ad technology services for which revenue information is available, Google’s revenue share was between 40% and 70% .

The ad technology services investigation was closed after the ACCC made these findings, with the watchdog now considering how to implement broader ad technology changes as part of the ad technology investigation. digital platform services.